Thoughts on Inflation, the Stock Market, & the Economy

Stocks fell into a bear market this week and the pundits say that a recession may be on the way.

What should you do?

If you’re asking this question about your investment portfolio, then the answer is ‘nothing’.

As a long term investor, your portfolio should be appropriate for your personal goals and your personal time horizon.

(If it isn’t, then the answer is to move to a more appropriate portfolio for you.)

There will be periods when your portfolio decreases (potentially longer periods than we’ve seen recently) and it will suck.

It’s the fee that you pay to enjoy the good times.

The data shows that it’s extremely unlikely that we can time the market.

We have to be right on both sides of the trade – when to sell out and when to buy back in.

Additionally, the best days in the market have often come on the heels of the worst days.

If we sell out because we’re scared we could miss out on a lot of the upside.

The best thing to do is to turn off the TV and stop reading the headlines.

If a recession is coming, then you would be better suited figuring out how that could impact your job and if there’s anything you can do to help mitigate those risks, including bolstering your emergency fund.

We’re typically intentionally quiet on these things because they are noise that if acted upon can disrupt a sound long-term investing strategy. While we haven’t had any clients reach out to us to speak about what’s going with inflation, the stock market, and the economy, I thought it would be a good time to share some of our thoughts on our investment philosophy and our portfolios.

Inflation

Inflation is the highest that it has been in over 40 years. According to CNBC, “The consumer price index rose 8.6% in May from a year ago, the highest increase since December 1981. Core inflation excluding food and energy rose 6%. Both were higher than expected.

The major contributors to inflation over the past year have been oil (gas), food, energy, and housing.

While it’s certainly no consolation, the 10-year average inflation rate through 2021 was 1.88% and the 20-year average was 2.16%.

If we assume that inflation ends the year at the most recent reading of 8.6%, and that it continues at that rate for 3 years, then the 10-year average will jump to 3.94% and the 20-year average will increase to 3.12%.

(I’m not saying that I expect any of this. This is simply an example.)

Inflation hurts because it affects everyone and (almost) everything. You feel it when you go to the grocery store, when you fill up your gas tank, and when you pay your monthly energy bills.

The stock market is going down. Should we sell out of stocks? When do we get back in? If we set a strategy to get back in, will we have the guts to do it once the time comes?

The bond market is going down as interest rates are rising in an attempt to curb inflation. Do we sell out of bonds? Again, the same questions as above. Additionally, what if the Fed decides it needs to stop raising interest rates and bond prices begin to increase?

There’s no great answer right now for what we should do. It sucks. It’s part of what we signed up for as long-term, evidence-based investors.

The Stock Market

As of the market close on May 16, 2022, the S&P 500 is down 22.50% year-to-date, the Dow is down 17.64% year-to-date, and the NASDAQ is down 31.95% year-to-date.

That’s definitely not fun and tends to cause a lot of investors to worry and wonder if they should make changes to their portfolios.

The market doesn’t go up all of the time. We shouldn’t expect it to. We have been spoiled since 2008 with the only negative year in the S&P 500 since then being 2018, which was only down -4.38%. Many have gotten used to this.

We encourage you to zoom out.

While the numbers so far this year aren’t promising, if we zoom out, we can see a different story.

S&P 500 YTD Return: -22.50%

S&P 500 1-Year Return: -12.39%

S&P 500 5-Year Return: +64.84%

S&P 500 10-Year Return: +227.41%

A positive way to spin the recent stock market declines if you are a buyer is that you have the opportunity to buy more shares of stocks, mutual funds, ETFs, or whatever you prefer to invest in on sale at cheaper prices than when the stock market was higher.

Future Stock Market Returns

As stock prices are falling, that means that future expected returns are rising. If you think it will take the S&P 500 three years to get back to where it was in January, then you’re expecting a greater than 7% return over those three years. If you think it will take two years for the S&P to get back to where it was in January 2022, then you’re expecting an annual return of greater than 11%.

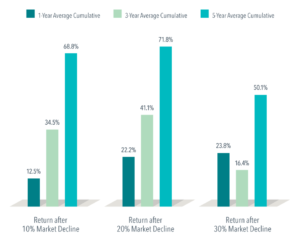

Consider this research from Dimensional Fund Advisors:

“On average, just one year after a market decline of 10%, stocks rebounded 12.5%, and a year after 20% and 30% declines, the cumulative returns topped 20%. Over three years, stocks bounced back more than 30% from declines of 10% and 20%, although—while still positive—returns were not as impressive after 30% declines. But five years after market declines of 10%, 20%, and 30%, the average cumulative returns all top 50%.

A look at the data makes a case for sticking with a plan. Handsome rebounds after steep declines can help put investors in position to capture the long-term benefits the markets offer.”

(Source: History Shows That Stock Gains Can Add Up after Big Declines, Dimensional Fund Advisors)

The Economy

The National Bureau of Economic Research (NBER) defines a recession like this:

“The NBER’s traditional definition of a recession is that it is a significant decline in economic activity that is spread across the economy and that lasts more than a few months. The committee’s view is that while each of the three criteria—depth, diffusion, and duration—needs to be met individually to some degree, extreme conditions revealed by one criterion may partially offset weaker indications from another.”

I’m not an economist and I’m not going to pretend to be one. One of my favorite finance writers, Ben Carlson, wrote this in his June 7, 2022 blog titled Timing a Recession vs. Timing the Stock Market:

“The unemployment rate is still 3.6%. Wages are rising. Consumers are still spending money like crazy.

We could be in a recession right now but the fact that the U.S. economy added 1.2 million jobs in the past 3 months would seem to counter that argument.

Maybe this is just a poorly worded survey or maybe people really hate inflation.

Yes, inflation is the highest it’s been in 40 years but high inflation does not mean we are currently in an economic slowdown.

However, the possibility of a recession is certainly elevated because inflation is so high at the moment. It’s going to be difficult to bring it back down without causing a recession.”

I’d highly recommend reading the rest of his article as he makes some very interesting points.

Our Portfolios & Financial Plans

Our portfolios have been built with the long-term in mind and our clients’ individual financial plans and portfolio strategies have been built knowing that there will be crashes, bear markets, and recessions. It’s inevitable and it would be irresponsible of us to ignore the possibilities.

While the shortest bear market ever from February 19, 2020 through March 23, 2020 only lasted 33 days, the bear market of 2007 to 2009 lasted nearly a year and a half.

According to Investopedia, “The average length of a bear market is around 9.5 months and occur, on average, around 3.5 years apart from each other.”

While a year or two of declining markets feels like a lifetime while going through it, 1-2 years is not long-term in the grand scheme of things.

Remember, we’re long-term investors (yes, even you, retirees). Our financial plans and portfolios are built for the long-term, not just for the next 1-2 years.

Our goal is to help our clients stay invested through good times and bad. As mentioned above, our clients are placed in portfolios that are appropriate for their goals and their time horizons. Those who are younger and have a longer time horizon before they will need to generate income from their portfolios generally tend to have more aggressive portfolios compared to those who are closer to, or in, retirement who tend to have more conservative portfolios.

Given the low likelihood of successfully timing the market, the goal is to stay invested as long as possible.

Time in the market > Timing the market

When the market, the economy, and whatever else gets scary, we’re here to act as coaches for our clients to help them stick it out and ride the waves.

As we mentioned in our previous blog post, Expect the Market to Crash, we really like the way that Morgan Housel writes about stock market volatility (AKA the big declines we just discussed).

He writes, “Fees are something you pay for admission to get something worthwhile in return. Fines are punishment for doing something wrong.”

We should think of declines in the stock market as fees, rather than fines. Your portfolio dropping due to the market dropping isn’t a fine, it’s a fee that has to be paid in order to obtain long-term gains.

What Am I Supposed to do with This Information?

I’m going to repeat what I wrote at the beginning of this post. If you think that you can hide from a bear market or a recession, then you may not be considering what the alternatives are. The best thing to do is to turn off the TV and stop reading the headlines.

If a recession is coming, then you would be better suited figuring out how that could impact your job and if there’s anything you can do to help mitigate those risks, including bolstering your emergency fund.

As I remember my mom saying often when I was a kid: “This, too, shall pass”.